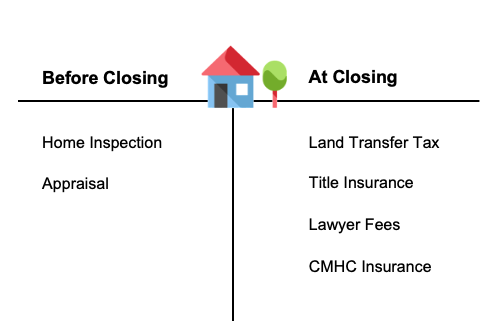

Closing costs are costs that one will incur when closing the purchase transaction. These costs can be significant. A failure to budget for closing costs may lead to unpleasant surprises or even impact your closing. Major closing costs include home inspection, appraisal, Land Transfer Tax, CMHC Insurance premium (if applicable). We have laid them out based on whether the cost will incur before or at the time of closing. This will help you plan accordingly. Let’s go through them one by one.

Costs Before Closing

Home Inspection Fee

Home inspection ensures there are no hidden issues with the property that you want to purchase. A home inspection may save a lot of money down the road. For example, if the roof needs replacement within the next few months, you may want to price that into your offer price. Many prospective home owners make an offer subject to home inspection. This allows them identify any potential issues with the house before firming up the deal.

Depending on the size of the property, a home inspection typically costs between $300 to $500.

Appraisal

An appraisal is an independent valuation of how much the house is worth. Your lender will require an appraisal to ensure thay they use a realistic home value to lend against. For example, if you paid $800,000 for the house and the appraisal report comes back to be $600,000; it means based on the appraisal you overpaid on the purchase. When the lenders provide your funding, they will calculate their ratios using $600,000 rather than the actual purchase price.

An appraisal can cost between $300 to $450. For a new purchase, lenders usually pay the cost of the appraisal. For a refinance transaction, you may have to pay for the appraisal out of pocket.

Costs at the Time of Closing

Land Transfer Tax

Land transfer tax is a tax that most provinces will charge to transfer the onwership of property from one person to the next. All provinces have some form of land transfer tax or fee. Homebuyers in the City of Toronto incur an additional municipal tax.

The tax is calculated as a % of the purchase price of the property. Below is the Land Transfer Tax Rate table detailing the rates used by Ontario and the City of Toronto. You will notice, the higher the purchase price of your house, the higher the Land Transfer Tax.

If you are a First Time Home Buyer, you qualify for a rebate on Land Transfer Tax up to a certain amount. The maximum rebate is $4,000 for provincial tax, and $4,475 for municipal tax. Here’s the formula to calculate your net Land Transfer Tax:

Land Transfer Tax = Provincial Tax + Municipal Tax – First Time Home Buyer Rebate

Land Transfer Tax example:

- If you purchase a house at $300,000 in Oakville, your Ontario Land Transfer Tax (see table above) is $2,975. You have no municipal tax in this case as the property is outside of Toronto

- If you purchase a property for the same price in Downtown Toronto, your Land Transfer Tax is now $5,950 ($2,975 provincial tax plus $2,975 municipal tax

Use the Land Transfer Calculator to find out how much your Land Transfer Tax is.

First time home buyer rebate:

- For your purchase in Oakville, if you are a First Time Home Buyer, you are eligible for a rebate up to $4,000 on the provincial tax. Therefore, your net Land Transfer Tax is zero.

- Similarly for first time home buyers, the City of Toronto provides a rebate up to $4,475. Therefore, you provincial land transfer taxes will also be zero.

You can use our Land Transfer Tax Calculator to effortlessly calculate the Land Transfer Tax on different properties.

Title Insurance

Title insurance is an insurance that your lender purchases to protect themselves against fraud or error regarding to the ownership of the property.

The cost is around $200 to $1000 depending on the size of your mortgage and is usually borne by the mortgage lender, however it may differ from lender to lender.

Legal Fees

Legal Fees can range between $1,000 to $2,000 depending on the complexity of the transaction. If you are refinance your property, there are no legal fees because a lawyer is not required for a refinance transaction.

CMHC Insurance Premium

It is also sometimes called Mortgage Default Insurance. It is required when your down payment is less than 20% of the price of your property. The Insurance Premium itself is normally added to your mortgage, i.e. capitalized as part of your mortgage principle. However, the Provincial Sale Tax (PST) has to be paid at closing. In Ontario, the PST is 8% of your CMHC Insurance Premium (NOT your property price). You can find out whether you need to purchase CMHC Insurance in this article.

Other Things to Consider at Closing

Down Payment

Make sure to have your down payment ready in a chequing account a few days before closing. The down payment amount is often large, ensure that your Financial Institutions does not have limitations to how much you can withdraw in any given day.

Some people may choose to leave their down payment in a High interest savings account or other investment account to earn interest while waiting for the closing. That’s perfectly fine, however do ensure that the redemption rules of your investment account allows you to withdraw the required down payment.

Survey

A Survey is a detailed map of the legal boundaries of your property, including detailed description of your lot size and pattern, location of easement, etc. It is not required for a home purchase, but we highly recommend you ask for it from the seller if they have it. A Survey becomes extremely useful if you need to do any major renovations that require a building permit to the house in future. And it can cost a few thousand dollars to complete a new one.

To Sum it up

Buying a home is exciting, especially the days leading up to the closing date. Don’t let unexpected closing costs add undue stress to your home purchase. Use our Closing Cost Calculator to help plan ahead and stay away from unpleasant surprises.