Our home means a lot to us. It reminds us of all the good times, all the laughter we shared with friends and family, and to a certain extent, it signifies our identity. That’s why many senior homeowners choose to continue to stay in their homes rather than downsizing. As it gets more and more difficult for Canadians to save for their retirement, more and more homeowners are using Reverse Mortgage to supplement their retirement income and continue to live in their own homes. Let’s look at what is a Reverse Mortgage and the pros and cons that comes with it.

1. What is a reverse mortgage?

A reverse mortgage allows you to take money out from your home equity without making monthly payments until the end of the term. Similar to a mortgage, it is secured against your home. It’s usually geared toward senior homeowners, who have accumulated large amounts of equity in their homes and are in need of cash flow.

2. Who is eligible?

Age

55 is the magic number for reverse mortgage. To qualify for a Reverse Mortgage you have to be 55 years or older.

Figures from Statistics Canada show that the 55-64 age group has the highest homeownership rate at 76.3%.

Home Equity

A reverse mortgage allows you to borrow up to 55% of the value of your home. As such, if you currently have a mortgage on your home, the mortgage balance can be no more than 55% of your home value. In other words, you need to have at least 45% of equity build up in your home (Home Equity = Value – Existing Mortgage Balance). In most cases, people who consider reverse mortgages have a lot more equity than that. Many even had their homes fully paid off. Keep in mind 55% is the maximum amount of equity one can qualify for. The % is usually lower for borrowers who are at the lower end of the age spectrum.

Location

A reverse mortgage heavily relies on the equity in your home and how much the home can be sold for when you move or sell, reverse mortgage lenders tend to emphasize a lot more on the location of your home. For example, if you have a large property in a rural area, it may considered too “illiquid”. It means it’s harder to sell the property and the price is hard to predict. Therefore, you may not be eligible. However, if you live in a subdivision that’s close to transit and has steady real estate market, the chance of you getting approved is a lot higher.

3. How much can you qualify for?

It depends on the value of your home. As mentioned above, you can qualify up to 55% of your home value. Also, the older you are, the more equity you have in your home and the better the location; the more Reverse Mortgage amount you can qualify for.

4. What are the Benefits of a Reverse Mortgage?

Here are the top three reasons why people choose to get a reverse mortgage:

1. Reverse Mortgage Gives You Tax Free Cash Flow

The definition of retirement today is a lot different than a decade ago. People over 55 remain more and more active. They are in better heath than their previous generations. They want to travel more now that the kids have left home. The increased desire to do more in your retirement comes with more spending. Because a Reverse Mortgage doesn’t require monthly payments, it is a great way to supplement retirement income and fulfill your goals. You worked hard for your retirement and invested wisely in your home. A Reverse Mortgage can help you reap the value of home equity while maintaining ownership.

2. Reverse Mortgage Allows You to Live in Your Home & Cash In Home Equity at the Same Time

Since, people are retiring younger and more able bodied, they prefer to continue today in their home as long as they can. However, by keeping the home, their home equity is “trapped” in there as well. Reverse Mortgage allows you to KEEP your home while “Cashing In” your home equity – it enables you to “Eat Your Cake and Have It Too”.

3. Reverse Mortgage Allows You to Help a Family Member with Down Payment or Education costs TODAY not LATER

The younger generation lives in a different world when it comes to home prices. In 1976, it used to take 5 years for a median income family to save up to 20% of down payment. Today, it takes on average 13 years nation-wide, and almost 30 years to save up 20% of the down payment if you live in pricier cities like Toronto. Those figures will continue to edge higher as inflation kicks in. Therefore, more and more of the younger homebuyers are looking to their family for help. Today over 30% of First-Time Home-buyers use Gifted Down Payment from their parents or grandparents to purchase their first homes. Reverse Mortgage allows you to provide that “helping hand” to your children or grandchildren without having to sell your home.

Another good use of Reverse Mortgage is to help finance a family member’s education. Education can be expensive, and it may take years for your children to payoff their student loan. Why not help them be debt free right after they finish their university to give them a head start?

Taking a Reverse Mortgage is like giving your children a “Living Inheritance” – TAX FREE. It means you can help them NOW vs. LATER while continue to live in your own home.

5. How much are reverse mortgage interest rates?

Currently reverse mortgage rates are 1% higher than the traditional mortgage rates. This is because a lender needs to take on additional risk with a Reverse Mortgage.

For a conventional mortgage, your mortgage balance owing is reduced by your monthly payments. Since you do not need to make payments with a Reverse Mortgage, your principle amount actually increases as interests get capitalized to your mortgage principle. Therefore, the mortgage amount owing increases as time goes by, which in turn, increases the lender’s exposure to potential losses.

Further more, lenders adjudicate conventional mortgages based on both the equity in your home, as well as your income. Whereas the underwriting of a Reverse Mortgage is heavily relying on your home equity.

6. How do you pay back a reverse mortgage?

Unlike a Conventional Mortgage, a Reverse Mortgage doesn’t require you to make monthly payment. Interest is simply added to your principle. The entire mortgage balance including principle and accumulated interest is paid back when you decide to move or sell.

You also have the freedom to make monthly payment or annual payment towards the mortgage if you choose to. There are many reverse mortgage products designed to fit your needs. Talk to one of our experienced Reverse Mortgage Advisors to see what option works best for you!

7. Can I lose my house with a reverse mortgage?

In Canada, you CAN NOT be forced out of your home as long as you maintain your home in good conditions, and keep insurance and property taxes up to date. You only need to pay back the mortgage when you have:

- decided to move to a retirement home, or

- decided to sell your home, or no longer use it as a primary residence

- You AND your spouse (if applicable) have passed away

8. What happens when you outlive your reverse mortgage?

The answer is you CANNOT outlive your reverse mortgage. As long as you keep paying your home insurance and property tax, you can continue to live in your home. Even if your spouse pass away, you CANNOT be forced out of your home.

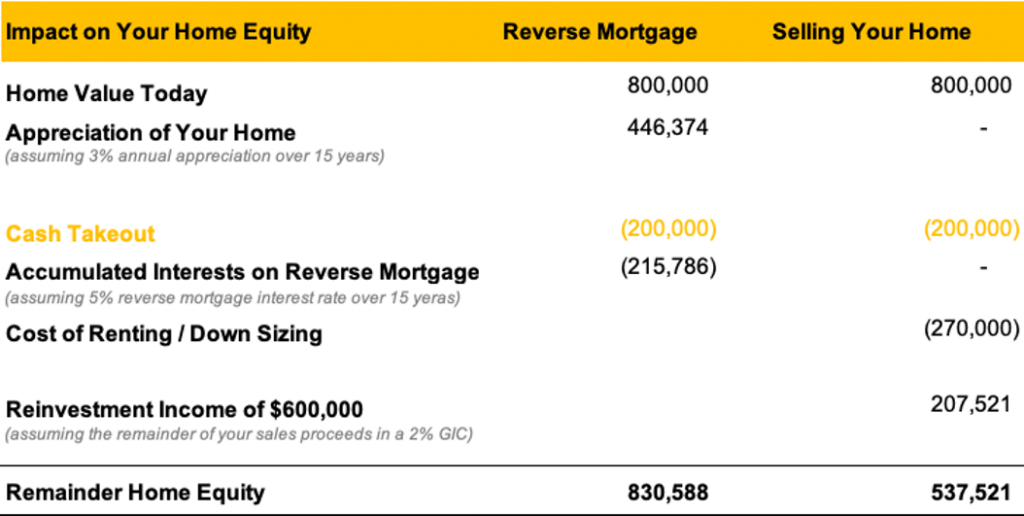

9.How does a Reverse Mortgage impact your home equity?

One of the biggest myths about Reverse Mortgage is that you will lose your home equity. You still OWN your home with a Reverse Mortgage. In fact, you continue to enjoy the appreciation of the home. In a good housing market, by staying in your home and leveraging a Reverse Mortgage, you may end with more home equity in your home than downsizing.

Let’s look at an example:

- Your home is currently worth $800,000 and free & clear

- You want to take out $200,000 to supplement your retirement income

- Assume your house appreciates 3% per year on average

- You plan to live on your own for the next 15 years. After that you will move in with one or your kids or move to a retirement home.

Option A – Get a $200,000 Reverse Mortgage

- In this case you pay nothing until you decide to move 15 years from now

- The cost of borrowing equals to $215,786 accumulated interest

- However, by continue owning your home, at the end of the 15 years, your home would have appreciated by $446,374. It outweighs the cost of interest.

- At the end of the 15 years, after paying off the Reverse Mortgage, you will be left with $830,588 home equity

Option B – Sell Your House Now, take out $200,000 cash and move to a smaller place

- In this case you will receive $800,000 sales proceeds right away

- After taking $200,000 to supplement your retirement, you will be left with $600,000 cash to invest

- Assume you put the $600,000 into a GIC yielding 2%, over 15 years, you would earn $207,521 interest income

- You also need to take into account of rent or payment for another mortgage if you decide to downsize. Let’s call it $1,500 per month, and it will cost you $270,000 over 15 years.

- At the end of the 15 years, will you be left with $537,521 home cash.

We summarized the financial impact of the two options below. Depending on the interest rate and the housing market, a Reverse Mortgage may leave you with more home equity than other options.

10.How to apply?

There a few lenders who offer Reverse Mortgages at different rates and terms. It’s best to consult our experienced Reverse Mortgage Advisors to help you understand your options and guide you through how to apply.

The Bottom Line

We have summarized the pros and cons of getting a Reverse Mortgage below. Getting a Reverse Mortgage is often not a decision you make overnight, nor should it be a decision made alone. Discussing your intentions with your family can help you figure out whether it’s the right chose for you. Our experienced advisors are always here to answer any questions you have.

Pro’s

- No monthly payments

- Continue to OWN your home

- Continue to LIVE in your home

- Still benefit from your home appreciation

- Loan proceeds are Tax-free

- Flexible options to receive the mortgage – it can be taken out as a lump sum or as needed

- The remainder home equity can still be left to your heirs

- Cheaper than a private mortgage, which can be around 8% to 10%

Con’s

- The interest rate is about 2% higher than conventional mortgage

- The accumulated interests will be taken out of your home equity

- If you choose to pay off your mortgage before the end of the term, there will be penalties

- If you fail to maintain your property tax and home insurance payments, the lender can choose to enforce the mortgage