“If you follow these steps, the home buying process will be less stressful and you can avoid costly and unnecessary mistakes.”

Like many Canadians, owning a home is something Meghan always wanted. It was love at first sight when Meghan found her first home — a small bungalow in Oakville, just 5 minutes from the GO station.

Meghan still remembers every bit of it. At the open house, she walked around the rustic living room repeatedly — closing her eyes to imagine what colour of paint she would use, what the dining room would be like with friends over on weekends enjoying BBQs and mint-infused watermelon punch!

What she didn’t know at the time was how overwhelming the first-time buying experience can be.

“After I over bid two other buyers and won the offer, the reality hit…I have gone $30,000 above my budget! Can I close the mortgage?!” Meghan relayed to us during her initial phone call with Effortless Mortgage.

“I have no idea what the next steps are. What do I need to do to firm up my mortgage? What are the things to watch out for? The information out there all seems to be very generic.”

When it comes to the home buying process, especially for the first-time home buyers, Meghan is not alone.

According to the most recent first-time home-buyer survey issued by the mortgage insurer, Canadian Mortgage Housing Corporation (CMHC), there’s a clear increase in uncertainty about the homebuying process.

Nearly half of homebuyers are concerned about unforeseen cost; 42% of all home buyers said they felt uncertain about the homebuying process – including first-time and next-time homebuyers.

After helping countless Canadians successfully close their mortgages and own their first homes, we summarized the homebuying process into 8 easy to follow steps.

#1 KNOW YOUR BUDGET

How much mortgage can you afford? What's the realistic home price ranges that will work for you?

To understand how much mortgage you can qualify for, you need to ask yourself the following:

- How much down payment do I have?

- What is my debt-to-income ratio?

- What is my credit score?

DOWN PAYMENT

The amount of down payment you need depends on many factors, especially your credit score.

Here’s the general rule of thumb:

- If your credit score is greater than 600, you need minimum 5% of the property price as down payment

- If your credit score is less than 600, you need minimum 20% of the property price as down payment

For example, if you are buying a $400,000 house, the minimum down payment you need is $20,000 if your credit score is >600. You need $80,000 down payment if your credit score is < 600.

Your down payment can only come from the following sources:

- Your own investment and savings

- Gifted by immediate family members

Most lenders require 90 days history of your down payment, i.e., you should have the bank or investment statement of the past 3 months as proof for your own down payment as well as gifted down payment.

Please keep in mind that aside from your down payment, you want to keep a little bit of extra for closing costs to ensure a stress free mortgage closing. We will talk a little more about it later on in this article.

DEBT-TO-INCOME RATIO

In addition to down payment, your income also determines how much mortgage you can qualify. Mortgage lenders use Total Debt Service (TDS) ratio to calculate how much monthly payment you can service without stretching yourself too much.

We won’t bore you with the long formula mortgage lenders use to derive at your Total Debt Service Ratio – it’s basically all your monthly debt payment plus property costs divided by your monthly income.

We do want to share a short cut to assess your mortgage affordability based on your income. It’s not to the dollar but it’s… fast.

Generally speaking, if you don’t have a lot of other debt, you can afford about 5 x of your income. For example, if you make $80,000 a year before tax, you can probably qualify for ~$400,000 mortgage if you don’t have a lot of other liabilities. Obviously, the number changes if you have a $500/month car loan.

One exception is if you are self-employed.

When you are self-employed, getting qualified can be a little bit more complicated…but certainly doable and possible! In fact, Effortless Mortgage works with a good number of self-employed individuals as first-time home buyers!

You can find out more on how to qualify for a mortgage if you are self-employed in this article.

CREDIT SCORE

As mentioned earlier, 600 is the magic number for credit score.

We recommend First-Time Homebuyers to strive for at 650-680 credit score or higher for the following reasons:

- The higher your credit score the easier it is to get approved (all else being equal)

- Higher credit score gives you the greater chance to get the lowest interest rate

With that being said, not all credit scores are created equal.

For example, someone might have a 700 credit score, but defaulted on a credit card 2 years ago… that will definitely create some difficulties in getting a mortgage despite good scores. On the other hand, if your credit score is 590 just because you missed a few phone bills, it is something we can make a case for with the mortgage lenders.

#2 GET A MORTGAGE PRE-APPROVAL

The best way to understand how much mortgage you can qualify is to get a pre-approval.

A mortgage pre-approval is a holistic review of your financial situation to determine your mortgage affordability.

Here are the three reasons why you should always get a pre-approval as a First-Time Home-buyer:

- Gives you the most accurate estimate on how much mortgage you can afford and the range of home prices you can bid on and put an offer on – safely and knowledgeably.

- Saves you and your realtor time and helps you to win the offer of the home you want.

At Effortless Mortgage, we help with preparing the up-front work and collect key documents when we do the pre-approval. Therefore, when you need to bid on a property, all you need to do is to add the property to our mortgage application. It allows you to firm up a property purchase offer a lot faster vs. starting from scratch without a pre-approval.

Ask one of our experienced mortgage advisors on how pre-approvals work.

For a quick estimate, use this Mortgage Affordability Calculator.

Please note we always recommend you have a financing condition when you put in a purchase offer – we can’t tell you how many people went into a purchase firm and got stuck when they couldn’t get approved for the mortgage amount.

Having a no obligation call with one of our mortgage advisors will save you time, money and stress!

#3 START HOUSE HUNTING

Once you know how much house and mortgage you can afford and have a pre-approval ready, you can get ready for the fun part – house hunting!

STAY WITHIN YOUR BUDGET

We advise First-time Home-buyers to stay within 5% of their Pre-approved Budget.

For example, if you are pre-approved for a $500,000 home, you should only bid on homes between $475,000 and $525,000 (i.e. $500,000 + or – $25,000).

BE REALISTIC AND OPEN-MINDED

It’s best to keep an open mind and not to be dead set on one type of home in one particular neighbourhood.

For example, a few years ago, a young couple who had limited budget came to us and said they wanted to find a single detached Victorian home in the hot Annex neighbourhood in Toronto. They were presented some town homes in nearby neighborhood, but they refused to consider these options.

Meanwhile, they were constantly being out-bid by other buyers with bigger budget and real estate investors who were looking for the same type of home in this very in-demand neighborhood.

After one year of unsuccessfully bidding on their “dream home”, they realized the market had gone up by another 15% across the city, and they were no longer able to afford the townhomes they could have bought a year ago.

The gist of the story is to stay open minded and be realistic with your budget, instead of being overly fixated on one type of home/neighborhood.

The most important thing is to purchase your first home so you can start accumulating equity right away. In a few years, you can upgrade to your dream home in your dream neighbourhood!

BE AWARE OF CONDO FEES

Many First-time Home-buyers are surprised to learn that even condos/townhomes in the same market, with similar square footage and amenities can have very different condo fees.

Condo fees do make a difference in how much mortgage you can qualify.

For example, with a $500/month condo fee vs. a $1,000/month condo fee, you will be able to qualify for approximately $100,000 more mortgage amount.

It’s also important to do your due diligence on the condo management company to ensure they are in good standing and have good track record in keeping the maintenance fee reasonable as the buildings age.

Working with a good realtor who understands your needs is very important. If you don’t already have a realtor, ask us for a recommendation!

#4 MAKE AN OFFER

Exciting! Make an offer with a financing condition, always - regardless if you have a mortgage pre-approval.

Protect yourself with the right purchase conditions in your offer.

Purchase “Conditions” are clauses in your purchase contract that allows you to back out of the offer if certain conditions are not met.

The most common conditions are Financing Condition and Inspection Condition. Include these conditions to “protect yourself from getting stuck in a bad deal”.

FINANCING CONDITION

The Financing Condition states that your purchase offer is only effective if you can obtain a mortgage after the offer is accepted. Most Financing Conditions last 5 days. It means you have up to 5 days to get a “Firm Approval” from the lender. However, on some unique properties, such as a cottage property that requires more time for lender to do due diligence, the seller may give you up to 10 days or more to fulfill this condition.

Why is this important? If you have a mortgage pre-approval, most of the times you will get a “firm approval” after your purchase offer is accepted. However, in some cases, the lender may subsequently decline your deal due to the property or things they discover in the document verification process. It doesn’t happen often, but it does happen.

This is why no matter how hot the real estate market is, we would NEVER NEVER advise a First-time Home-buyer to go in firm on a home purchase offer, or waive the Financing Condition without getting a “firm approval”. If you only have 5% down payment, you absolutely need to ensure you put in proper conditions in your purchase offer. Because if somehow the lender withdraw from the “pre-approval”, you will have very few options with only 5% down payment available.

The exception is that if you have 20% down payment or more, and the purchase really makes sense for you, then you may consider dropping the financing condition at your own risk – the reason why we say that is the risk of not being able to get a mortgage with 20% down is relatively small (assuming you already have a pre-approval). If you have 20% down payment or more and still got declined by your lender, talk to us today – we can help.

INSPECTION CONDITION

The Inspection Condition is another important clause that can protect you against a bad purchase. An inspection is usually ordered after your offer is accepted (sometimes the seller may get a pre-inspection report before the offer day to accelerate the sale).

The Inspection Condition states your offer is only effective if you are happy with the inspection report. This is a very powerful condition that allows you to back out of the sale if there is major deficiencies identified during the inspection.

In addition, if there is minor things need fixing, it gives you the opportunity to add these fixes into the purchase offer or negotiate the price of the house accordingly.

For example, during the inspection, you discovered there is mold in the attic. You can put in an additional condition into the purchase offer stating that “mold must be treated” before the closing of the house. You can also negotiate price based on this discovery – as an example, you can ask the seller to reduce the price by $2,000 given that you need to fix the mold. Same applies to anything you find through the inspection – a broken stove, a leaking tap, cracks of a bathroom tile, etc.

If the seller has already done a pre-inspection, you can choose to review the report with a real estate professional, and only waive the inspection condition if you feel comfortable.

Buying a home is one of the largest investments in your life, you want to do everything you can to ensure you have made the right choice.

#5 ASK QUESTIONS!

The questions you ask depends on what is IMPORTANT to YOU. However, there are some specific questions that you should ask to have a "no-regret" home purchase!

Many First-Time Home-buyers thought negotiating offers is mostly about the price. It’s definitely a lot more than that.

This is the time to ask all the questions you need to help you assess the “value” and “condition” of the house.

Here are a few examples of questions you might want to ask:

- Are all the fixtures staying (for example, the seller might plan take the $5,000 chandelier with him – you need to know that before the offer)

- Is the furnace/water boiler rented? If so, how much is the payment per month? How much does it cost to purchase it? This helps you to get ahead of the carrying cost of the hosue before you close the purchase.

- How much do you pay for electricity and heating? Again depends on the age and the type of electronic and heating system, the cost can very. This helps you better plan the monthly cash flow after the purchase.

- Is there any easement being signed with the neighbor? This happens often in the downtown core of major cities. If there is a shared driveway or laneway, you might have an easement on the property – this means you cannot alter certain part of your property without modifying the easement (i.e. the right that your neighbor or the city can use part of your property that belongs to you).

- If there is a basement or another unit in the house, be sure to ask if the unit is “legal”. If the basement unit is illegal, it may lead to issue to with the city down the road. It can also cause problems during your mortgage financing.

This list is far from exhaustive. The questions you ask depends on what is IMPORTANT to YOU.

Avoid the … “I wish I asked about this…” after you sign the paper.

Ask away before you firm up your purchase offer!

Don’t let emotion get in the way

When you find your “dream home”, it’s easy to get caught up in a bidding war and end up over paying. There are a few issues with paying a price that’s higher than market. One being financing. When the mortgage lender orders an appraisal on the house, the value is typically based on the “sold” comparable in the past few months. For example, if similar homes in the neighborhood were sold for $500k in the past few months, whereas you paid $550k for your purchase, the appraisal for your home will likely be around $500k. Based on the appraisal, you over-paid by $50k.

In this case, if you were approved for 95% of the home value, the lender can only provide you up to $475k (i.e. 95% of the appraised value). Since you overpaid by $50k vs. the appraised value, you will need to come up with additional down payment.

This is extremely problematic for First-time Home-buyers, because not a lot of people can come up with more down payment at a moment’s notice. Then what? Well, you will have to back out of the deal.

Be clear headed and stay within your budget. If the home is over your budget, it’s not “the one”. You will find your dream home by staying patient and disciplined.

#6 FINALIZE YOUR MORTGAGE APPROVAL WITH A COMMITMENT LETTER FROM THE LENDER

Time to turn your mortgage pre-approval to a firm approval!

Now that you have found your dream house and your offer has been accepted, the next very important steps in the home buying process begins!

Many First-time Home-buyers thought they can just throw up their feet after winning the purchase offer. The steps after the offer date are even more critical in helping you closing the purchase. The clock of the 5-day financing clause starts ticking. It’s time to finalize your mortgage approval.

FIRM UP YOUR PRE-APPROVAL TO APPROVAL

The only difference between a mortgage pre-approval and firm approval is that lenders need to review the property purchase. Once you have the accepted purchase offer, ensure you contact your Mortgage Advisor immediately and provide the following documents:

- Signed Agreement of Purchase of Sales

- The MLS Listing of the property

Your Mortgage Advisor will review the home purchase documents and submit to the lender for firm approval.

A firm approval from a lender involves the lender issuing you a mortgage commitment letter.

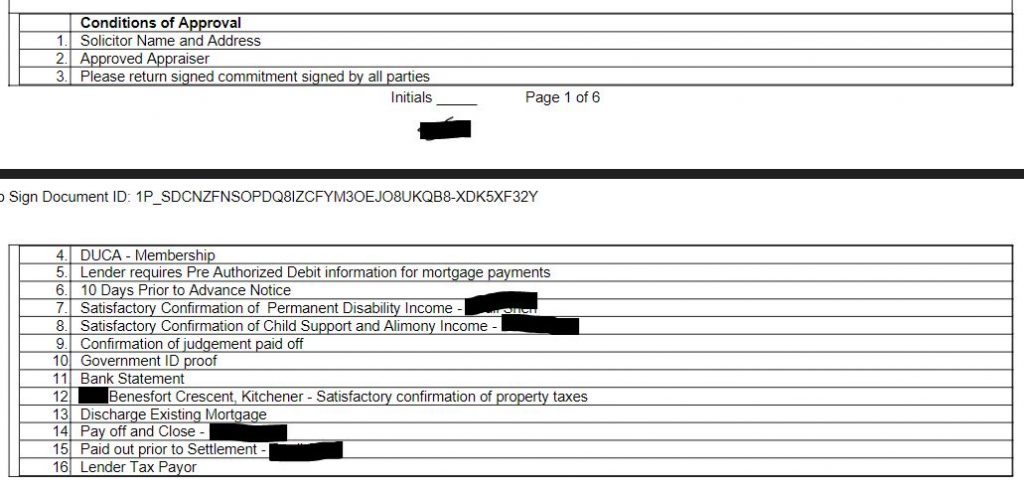

#7 FULFILL YOUR MORTGAGE CONDITIONS

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

After reviewing the Agreement of Purchase and Sale (offer), the lender will issue an mortgage Commitment Letter.

This is the “firm approval” you have been waiting for!

Your Mortgage Advisor will walk you through the Commitment Letter to explain the terms of the mortgage offer, such as the amount, term, amortization, monthly payment, outstanding conditions, etc.

All Commitment Letters come with “outstanding” conditions.

There is no need to stress! Most of the conditions are additional documentation and due diligence the lender need to complete before funding.

Your Mortgage Advisor will review the list of conditions with you to ensure you feel comfortable with these conditions.

Below is are a couple screenshot examples of conditions you will need to fulfill (it varies depends on the mortgage deal).

As part of the outstanding conditions, an appraisal of the property is USUALLY required.

The appraisal is an important part of the commitment.

An appraisal is an unbiased professional opinion of the value of a home and is used whenever a mortgage is involved in the buying, refinancing, or selling of that property.

Order The Appraisal

Sometimes an appraisal may not be needed. Lenders may choose to validate the value of the property using data and financial modeling. It happens more often for standard homes in highly populated neighbourhoods with sufficient recent sold data.

More often than not, you will need an actually appraisal report.

When an appraisal is needed, your Mortgage Advisor will order the appraisal report. The appraiser will reach out to your realtor to book a time to access the property. Ensure you let your realtor know to expect a call from the appraiser.

Delays in getting the appraisal report may impact your closing date.

This is more critical than you think – especially in the busy summer month when many appraisers are extremely busy.

If the appraiser cannot get into the property in time to do the appraisal, the completion of the appraisal report may be pushed out by a few days or even a few weeks.

And if the lender doesn’t like things they see in the appraisal report after they receive it, you will have very little time to find other solutions.

So be sure to stay on top of the appraisal.

Hold on tight until closing – don’t buy that new car yet!

You are almost there. You have fulfilled all the lender conditions and the closing date is approaching. Buying a new house is a big change in your life, it is very tempting to adjust your lifestyle as well… not so fast.

Interestingly, many people feel the urge to buy a new car around the same time as the home purchase. What comes with a new car is a new car loan or lease payment, which is reported on your credit report. Some lenders do tend to refresh the credit report after the firm approval and before the closing of the house. If they see a new car payment, they will need to include it in your monthly obligations, which will in turn impact the mortgage amount you get approved for.

Same goes with opening up a new credit card, changing jobs, over-spending on furniture and appliance. The list goes on. That’s why we created this article about the do’s and don’t before closing. It helped many First-time Home-buyers to ensure they do not do anything to jeopardizing their closing.

Budget for Closing Costs

Last but not least, talk to your Mortgage Advisor to ensure you have enough money stashed away for closing. Closing costs include but are not limited to Land Transfer Tax, lawyer fees, title insurance, moving costs, pre-paid property tax. The good thing is that as a First-time Home-buyer, you will likely get part of all of the Land Transfer tax refunded. You can use this calculator to estimate how much your closing costs might be.

#8 PLAN YOUR MOVE

Properly preparing and planning for your move will help you save time, effort and money...and save you from too much stress!

Your mortgage approval has been finalized. Now you are ready to move to your new home. Woohoo! Here are a few tips to help you plan it out smoothly!

Use your visit(s) wisely

Your purchase offer typically comes with 1-2 visits to the house before closing. You would be surprised to know how many people don’t even use these visits. These are the best opportunities to plan out your move and any renovation or work you need to do for the house.

If there are changes you would like to make to the property, it is a lot easier to make those changes early before you are fully settled in and have all the boxes unpacked. Bring your measuring tape, or even your contractor/interior designer with you on these visits to start drawing up the planned changes or fixes. I had a client who were planning to do a kitchen renovation to her first home. She booked her renovation consultation the same day as her visit and met the contractor at the house. Right after closing, she got the contractors in and out in one week to put in a new kitchen when she had a few extra days to live in her existing rental unit. She got to enjoy the kitchen right away without having to “live through” the renovation.

If you do not plan to make any changes to the property, the visits are still good to help you get a better feel for the house. You can start thinking about which furniture goes where, how to decorate, etc. The visits are yours to use. Don’t through them away.

Book your movers, early

Whether you decide to hire professional movers, or just need a few friends to lend you a hand for the move, you want to book them early. Meaning at least one month before the closing date. During the summer months, a lot of the good moving companies are fully booked months in advance. If you wait until the week before the move, you might still be able to find movers, but likely not the ones who provide the best service (well, unless you got lucky with some last minute cancellations).

I have personally made this mistake when I bought my first home. Given how overwhelming the first-time home-buying experience was, “booking a mover” totally skipped my mind. It only occurred to me two weeks before and I was left scrambling to call up every single ad on Kijiji… I was desperate. In the end I did find some “part-time movers” to help, but they are totally inexperienced – they left scratches all over the hallway of the new house and damaged a brand new dining table. It was a bad experience and a lessons learned.

If you currently live in a condo, or plan to move into a condo, you need to book the elevator even earlier. Although there are 30 days in a month, but an insane amount of moving and closings happen on the last day of the month. If the elevator is not available on your moving day, you are kinda stuck. So book it as soon as you have a firm offer in hand.

Call the utility companies, and the municipality

- Closing the old accounts: If your name is on the utilities bill for your current address, ensure you contact your utilities companies to ask for the final bill. If you forget to do so, you may continue to get charged. Of course you can sort it out with the water/gas/electricity companies, but we know all how stressful it is to be put on hold for 30 minutes and then get passed back and forth between client care and the billing department. I would avoid that at all cost.

- Opening the new accounts: This sound pretty simple and intuitive. However, when you first move into a house, you have a thousand things that need your attention. Most utility companies will not cut your power or water of the house even if you do not have an account with them at the beginning. However, it takes a few days or sometimes up to 10 days to set those up – if you don’t do them in time, you might be late for your first utilities bills. This may cause late payment penalties or even affect your credit score. And remember, when it comes to “getting on top of bills”, pre-authorized payment is your best friend.

- Find about your Property Tax: If you live in Toronto, you know the tax roll account has a gazillion digits. Once your property is closed, your info should automatically be added to the property tax bill. The issue is, you won’t be able to know when and where to pay the property tax if you don’t know the account number. You can get a copy of the property tax bill from your lawyer at closing. Make sure you save it.

- Understand your Garbage Collection Schedule: Unless you live in a condo, you will have to deal with the garbage collection schedule in your neighborhood. You want to know not only the schedule, but also the “rules”. For example, some cities allows you to fill up a black garbage bin based on the size you paid for, while other cities only use “garbage tags”. You also want to check if all the bins are still available to you on the property. For example, some cities actually ask new owners to pick up new bins from particular locations. Trust me, it is very unpleasant to find out on the morning of your first garbage day, that you don’t have a bin to put the garbage in… that will make things very “messy”, literally, and figuratively.

You’ve Got Mail – Change your address and use a mail forwarding service

Update your address on all the ID’s and accounts you can think of. Here’s a short list:

- Driver’s license

- Health card

- Car insurance (it may change your premium, for better or for worse)

- Bank accounts

- Credit card

- Update your employer/work so that tax slips like T4, or RRSP slips are mailed to the right address

Even after triple checking, you will still be missing a few vendors or subscriptions that you need to change address to. This is when a mail forwarding service comes in handy. You can set it up online with Canada post to forward your mail from the old address to the new one for a year at a reasonable cost. As you continue to receive forwarded mails, you will know which vendor you still need to change address with.