As Canadian homeowners feel the chill of a slower housing market and elevated mortgage rates, many are seeking ways to access their home equity without the drastic step of selling.

Two popular options stand out: Home Equity Lines of Credit (HELOC) and traditional mortgage refinancing. But how do they stack up in the current climate? Let’s unravel this, focusing on the benefits, drawbacks, and strategic considerations of each option.

Understanding HELOC and Mortgage Refinance:

Before we compare, it’s crucial to understand the basics:

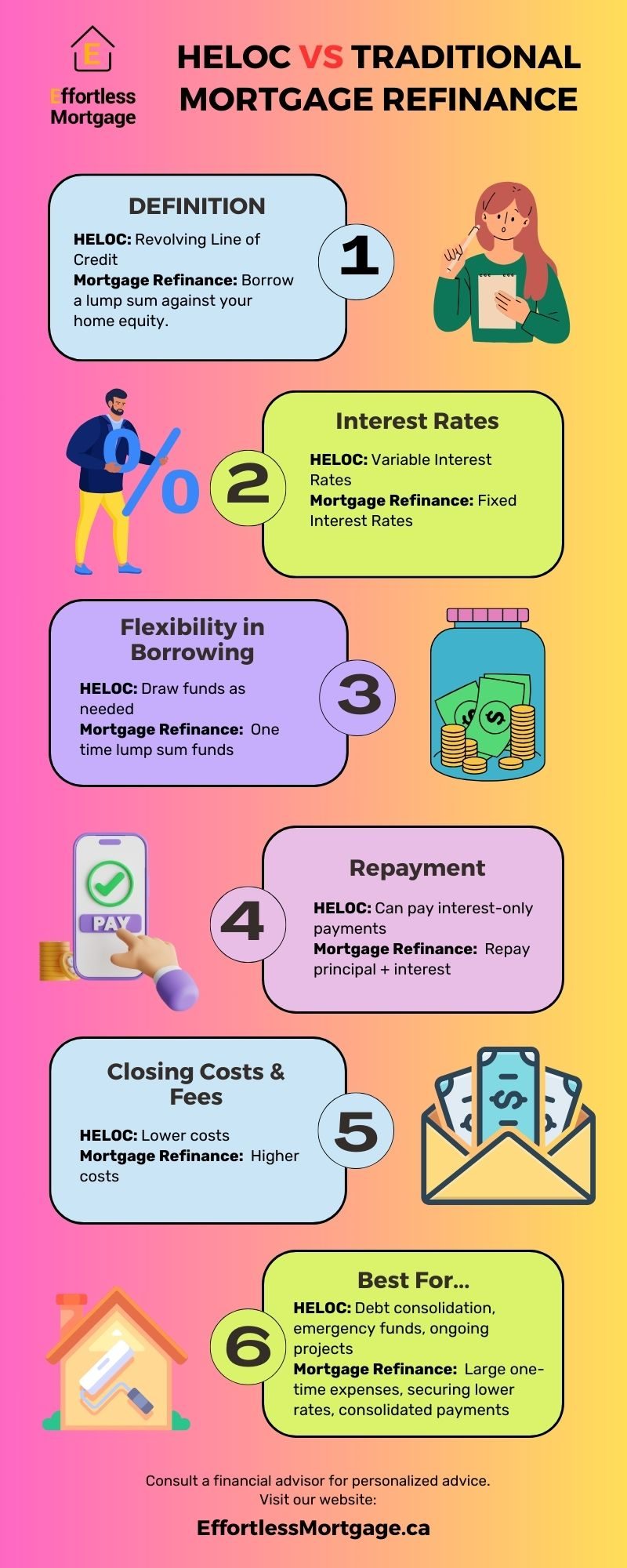

HELOC: This is a revolving line of credit that lets you borrow against the equity in your home. You can draw funds as needed, up to a certain limit, and pay interest only on the amount you borrow.

Mortgage Refinance: This involves replacing your existing mortgage with a new one, typically to take advantage of lower interest rates or to borrow a lump sum against your home equity.

The Current State of HELOC

- Interest Rate Variability: HELOCs generally have variable interest rates. With the recent fluctuations in rates, this could impact your repayments.

- Access to Funds: HELOCs offer flexible access to funds, a significant advantage in uncertain times.

- Repayment Flexibility: You’re usually required to pay just the interest monthly, which can ease financial pressure.

Mortgage Refinance in Today's Market

- Fixed vs. Variable Rates: Refinancing allows you to choose between fixed and variable rates, offering more predictability.

- Lower Interest Rates: Typically, refinancing can secure lower rates than a standard HELOC.

- Lump-Sum Borrowing: Refinancing gives you a lump sum, which is useful for large, one-time expenses.

Comparing HELOC and Mortgage Refinance

- HELOC: Offers more flexibility as you can draw funds as needed.

- Refinance: Provides a one-time lump sum, which might be more than you currently need.

- HELOC: Has variable rates, which can be a gamble in a fluctuating market.

- Refinance: You can lock in a lower fixed rate, offering stability.

Impact on Cash Flow:

- HELOC: Only paying interest can ease monthly financial burdens.

- Refinance: Typically, you’ll have higher monthly payments due to repaying both principal and interest.

- HELOC: Generally lower closing costs than refinancing.

- Refinance: Involves significant closing costs, which can add up.

Why Choose HELOC in Today's Environment?

- Financial Flexibility: Provides access to funds as needed without re-borrowing.

- Lower Upfront Costs: Fewer fees and lower closing costs compared to refinancing.

- Interest-Only Payments: Can be financially relieving during tougher economic times.

The Drawbacks:

- Variable Interest Rates: Can lead to unpredictable monthly payments.

- Risk of Over-borrowing: Easy access to funds might lead to financial strain if not managed wisely.

Why Consider Mortgage Refinance?

- Stable Payments: Fixed-rate options offer predictability in budgeting.

- Lower Interest Rates: Potentially more advantageous rates compared to HELOC.

- Lump-Sum Access: Ideal for large, one-off expenses like major home renovations.

The Caveats:

- Higher Closing Costs: Can be expensive initially due to various fees.

- Locked-In Terms: Less flexibility compared to the revolving nature of a HELOC.

Best Practices for Managing Home Equity

✅ Assess Your Financial Goals: Align your choice with your long-term financial plans.

✅ Stay Informed on Market Rates: Especially crucial for HELOC due to variable rates.

✅ Understand Terms and Conditions: Whether choosing HELOC or refinancing, know the fine print.

✅ Consult Financial Advisors: An expert’s perspective can guide you to the best decision.

Infographic: HELOC vs. Traditional Mortgage Refinance: Understanding Your Options

In Conclusion:

In the current Canadian housing market, both HELOC and mortgage refinancing offer unique advantages and challenges. A HELOC provides flexibility and easier access to funds, beneficial in an unpredictable economy. However, its variable interest rates demand careful monitoring. On the other hand, mortgage refinancing offers more stable and potentially lower rates, with the trade-off being higher upfront costs and less borrowing flexibility.

Your choice between HELOC and refinancing should be guided by your financial situation, future goals, and the current economic climate. Your home is not just a place of comfort; it’s a valuable asset that, when leveraged wisely, can significantly bolster your financial standing.

Whichever route you choose, staying informed and consulting with financial experts like the Effortless Mortgage team will ensure that your decision aligns with your long-term financial health.