Whether you are a first time home buyer and thinking of buying a home or you already own a home and thinking of refinancing, this article is for you. If you just want to understand mortgages and how they work, this article is also for you. A quote from renowned author Christopher Pike comes to mind, “A true teacher would never tell you what to do. But he would give you the knowledge with which you could decide what would be best for you to do.” We have written Mortgage Basics – Mortgage jargon made simple article to arm you with the knowledge of the mortgage industry starting with the very basics. Lets start with what a mortgage is.

What is a mortgage?

A mortgage is a type of loan provided by a lender (a bank, a credit union or other lenders) to a borrower (also called a mortgagor) for the purposes of buying a property. The property is the collateral or security against the loan.

Mortgage loans are usually large because buying a home is expensive. And due to the size of the loan, it usually takes a long time to pay-off these loans (sometimes as long as 25-30 years).

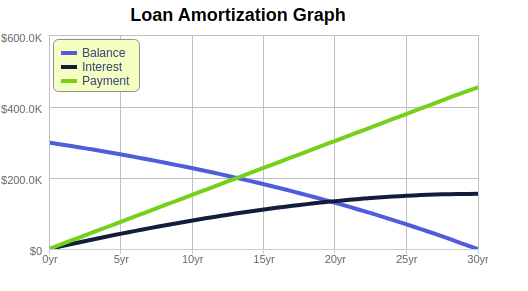

Under the terms of the loan, a borrower will usually make a payment towards the loan at least once a month. Part of the payment pays the interest on the loan and the remaining part reduces the outstanding loan. As such, for each subsequent a smaller portion of the payment covers the interest on the loan and a larger portion pays off the loan.

What is down-payment and how much do I need?

Mortgage lenders require the borrower to put some of their own money (also called down-payment) towards their home purchase. Typically, a minimum of 20% of the purchase price must come from the home owner and the balance is covered through a mortgage loan. If your credit quality is not the best, a lender may require you to put up to 35% as down-payment. On the other hand, if you are a first time home buyer, you may purchase Mortgage Loan Insurance and put down as low as 5% as down-payment.

What is mortgage loan insurance?

Mortgage loan insurance protects the mortgage lender in case you dont make your mortgage payments. It is mandatory in Canada for down payments between 5% and 20%. Canada Mortgage and Housing Corporation (CMHC) provides the required default insurance. It is calculated as a percentage applied to the total mortgage amount. Depending on the down payment, these insurance costs can range from 0.6% to as high as 4.5% of the mortgage amount.

What is mortgage pre-approval?

A pre-approval is a conditional approval for a mortgage loan provided by lender or your broker. The pre-approval will give you a fair idea how much you can borrow and at what rate. Armed with this information, you can go shopping for a home, especially in competitive real estate markets like Toronto. With a pre-approval you can make an offer to purchase a home with confidence. In addition, a pre-approval also locks your interest rates for 3 to 4 months.Should interest rates go up, your interest rate does not change. A pre-approval will also have information on your mortgage payments, mortgage term, mortgage type, interest rate type and your amortization, should you buy a home. Lets look at these terms in a bit more detail.

What is amortization and term?

As mentioned previously, a mortgage loan is a usually a large loan that is paid back over long period of time. The period of time in which the mortgage loan is paid back is called amortization. Mortgage amortization can be as long as 25 to 30 years. During the amortization period of a mortgage, you will have multiple mortgage terms. A mortgage term is the length of time your mortgage agreement and interest rate will be in effect.

In Canada, mortgage terms can range from 1 year to 10 years, with a 5 year term being the most popular. Therefore, if the amortization period of a mortgage loan is 25 years, it will be comprised of 5 5-year term mortgages. The end of a mortgage term does not mean that you have to pay off the mortgage loan. It simply means that the current mortgage term contract has lapsed, and you will re-negotiate the next mortgage term contract with your lender.

What about mortgage types?

There are two types of mortgages in Canada, open and closed. An open mortgage is a mortgage where extra payments can be made (including full repayment) at anytime without incurring a penalty (called prepayment penalties) regardless of the remaining term or amortization. A closed mortgage on the other hand is a mortgage where extra payments beyond what the mortgage contract allows can only be made at the end of the term without incurring an penalties.

Given that open mortgages provide a lot of flexibility, interest rates associated with open mortgage are usually higher than closed mortgages.

What about payment types?

There are two types of payment types – Fixed and variable payments.

A fixed payment is, as the name suggests, a type of payment that keeps your payments the same over the term of the mortgage, regarless of what happens to interest rates. If interest rates increase, your payments do not change. However, a higher amount from your payment covers the interest expense. On the other hand, if interest rates decrease, a lower amount from your payment covers the interest on your mortgage loan. In both cases, the remaining portion of your payment pays off the mortgage loan. With a fixed payment, when interest rates fluctuate, while you payments remain fixed, your amortization will fluctuate,

A variable payment on the other hand is a payment that changes as interest rates change. Therefore, payments will go up if interest rates go up and vice-a-versa. Because your payments fluctuate to cover the interest on your mortgage loan, the amortization of the loan does not fluctuate with interest rate changes.

A final word

Hopefully, this article has helped you understand some of the Mortgage Basics. When you are shopping for a home, keep in mind the amount of the down payment you have and the mortgage payment you can afford. Try our Mortgage Payment Calculator to compare the costs of different mortgage options.