As we step into 2024, Canadian homebuyers and homeowners are at a crossroads, navigating through the myriad of mortgage options available. The once-coveted 5 Year Fixed Rate Mortgage is now competing against the allure of Variable Rates and shorter-term mortgages, like the 3 Year Fixed Rate, which have gained popularity amidst the fluctuating financial landscape. This blog aims to demystify the choices between Fixed Mortgage Rates and Variable Rates, focusing on the strategic considerations for Canadian borrowers.

The Shift in Mortgage Preferences

The Canadian mortgage scene has observed a significant shift. While the 5 Year Fixed Rate Mortgage has long been the preferred choice for its stability and predictability, the current economic climate has led to a growing interest in Variable Rates and shorter-term options. The chatter among mortgage professionals and the market trend indicates a tilt towards these alternatives, propelled by the anticipation of rate decreases.

Understanding Fixed Mortgage Rates (History)

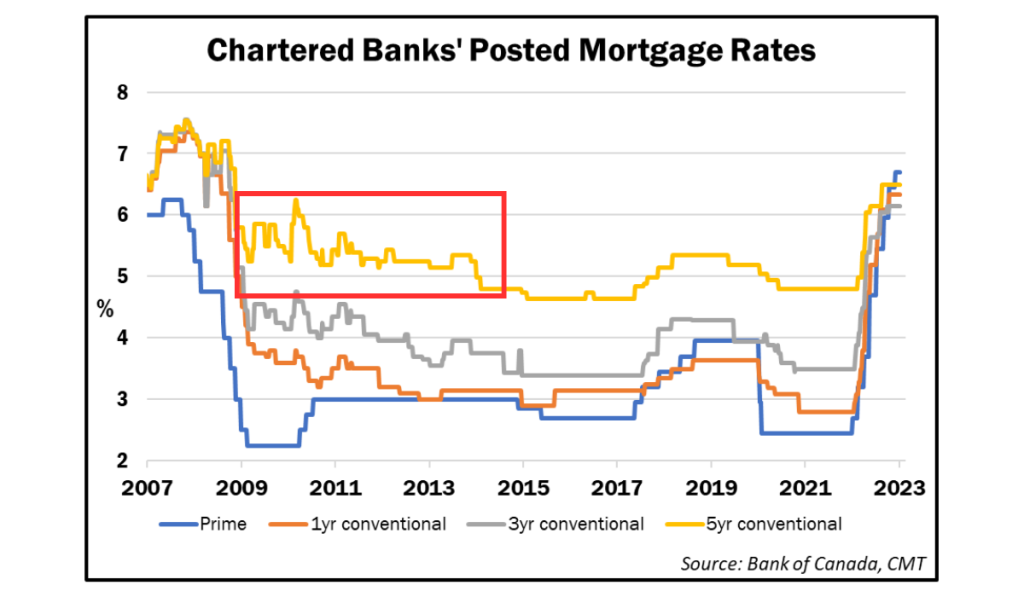

Fixed Mortgage Rates, particularly the 5 Year Fixed Rate, have historically offered peace of mind to borrowers. These rates provide a constant interest rate over the term, shielding borrowers from market volatility. Despite the market’s pivot, there’s a strong argument for sticking with a 5 Year Fixed Rate, especially when you consider historical data.

Over the past 20 years, the average 5 Year Fixed Rate hovered around 5%. Securing a rate in the high 4% to low 5% range today aligns with historical averages, offering a financially sound choice amidst the fluctuating rates.

Variable Rate: A Gamble Worth Taking?

On the other side of the spectrum lies the Variable Rate mortgage, a choice that’s increasingly catching the eye of Canadians in 2024. The allure of Variable Rates lies in their potential for lower interest costs, particularly if the Bank of Canada slashes rates. However, this option is not without its risks.

Variable Rates are currently a full percentage point higher, posing a significant gamble: Will the rates drop as anticipated, and if so, by how much and how quickly?

Choosing the Right Mortgage Option

Watch the video above (click the image). It will take you through your mortgage options in 2024.

The dilemma between opting for a 5 Year Fixed Rate or venturing into Variable Rate territory hinges on individual financial situations and risk tolerance. Here are a few considerations:

- For the Risk-Takers: If you have a robust disposable income and are open to the idea of your mortgage interest fluctuating in exchange for potentially lower rates in the future, a Variable Rate might suit you.

- For the Stability Seekers: Those who prioritize predictability and peace of mind, wary of any potential spikes in their monthly payments, might find solace in the 5 Year Fixed Rate Mortgage. It’s not just about avoiding surprises; it’s about ensuring that your financial planning remains on a steady course.

In the end, choosing between a 5 Year Fixed Rate and a Variable Rate mortgage boils down to a balance between financial stability and the willingness to navigate potential rate decreases. The key is to remain vigilant, informed, and prepared to pivot your strategy based on the evolving economic indicators and personal financial goals.

In Conclusion:

The Canadian mortgage market in 2024 presents a complex yet exciting array of options for borrowers. Whether you’re drawn to the predictability of a 5 Year Fixed Rate or intrigued by the potential savings of a Variable Rate, the decision requires careful consideration of your financial landscape and future outlook.

As we navigate through these uncertain times, staying informed and seeking expert advice can help illuminate the path towards making the best mortgage choice for your unique situation. Remember, the best mortgage strategy is one that aligns with your financial goals, risk tolerance, and the ever-changing economic environment.

Your Effortless Mortgage team is available 7 days a week. Feel free to ask any questions about home purchase, home refinance, home renewals, real estate investing, private lending, home equity line of credit, self employed mortgage, bad credit mortgage, and so much more.