Are you feeling the weight of your mortgage payment? As a homeowner, finding ways to ease this financial burden can significantly impact your quality of life.

In this comprehensive guide, we’ll go through proven strategies that can help you reduce your mortgage payment in Canada. From extending your mortgage amortization to refinancing and exploring interest-only mortgages, we’ll walk you through each step to help you regain control of your finances.

MORTAGE RENEWAL TIPS

Tip #1: Extend Your Amortization

Is there a way to make your mortgage more manageable without sacrificing your financial stability? By extending your mortgage amortization you will be spreading out your mortgage payments over a longer period. Effortless Mortgage can help you lower your monthly payment amount, and with this you can raise your cash flow. It is crucial for you to know the benefits and potential downsides, Here´s what you need to know:

Pros

- Lower Monthly Payments: Extending the amortization period will spread out your loan payments over a longer period of time, resulting in lower monthly payments. This can improve your cash flow.

- Immediate Financial Relief: If you’re facing short-term financial difficulties, extending the amortization can provide some breathing room by reducing your monthly financial commitments.

- Investment Opportunity: With lower monthly payments, you might have more funds available for other investments or financial goals, such as pursuing other investments with potentially higher returns.

- Higher Total Interest Payments: Extending the amortization period will result in paying more interest over the life of the loan. Even though your monthly payments are lower and you can take advantage of that extra cash flow.

- Interest Rate Changes: If you have a variable interest rate mortgage, extending the loan term could expose you to interest rate fluctuations for a longer period, potentially leading to higher payments if rates increase.

Tip #2: Lock Into a Fixed Rate Term

The unpredictability of interest rates can affect your monthly budget. To regain a sense of financial stability, consider locking into a fixed rated term for your mortgage. This strategy stick your interest rate and your mortgage monthly payment will stay the same throughout the term of your mortgage. However is important for you to take in consideration the following statements:

Pros

- Predictable Payments: Your interest rate remains constant and result in predictable monthly payment, making it easier to budget for your monthly costs.

- Stable Interest Costs: You are shielded from fluctuation of the interest rates. This can provide financial stability and protect you from potential future interest rate hikes.

-

- Higher Initial Rates: Fixed rate mortgages usually start with slightly higher interest rates compared to the adjustable rate mortgages.

- Potentially Higher Overall Cost: If prevailing market interest rates drop significantly after you lock your fixed rate, you might end up paying more interest over the life of the loan compared to what you would have paid with a variable rate.

Tip #3: Consider Interest Only Mortgages

Have you ever considered paying only interest portion of your mortgage for a specific period? An interest only mortgage also know as private mortgage is worth exploring. During this time, your monthly payments are lower, allowing you to redirect funds towards other financial goals. However, it´s essential to proceed with caution and understand the pros and cons involved:

Pros

- Lower Initial Payments: During the interest only period, you´re only required to make payments equivalent to the interest portion of the loan, resulting in significantly lower monthly payments compared to a fully amortizing mortgage.

- Investment Opportunity: With lower monthly payments, you might have extra funds available to invest in other opportunities leading to higher returns than paying down the principal.

-

- No Principal Reduction: The most significant drawback of interest-only periods is that they don’t contribute to paying down the principal amount of the loan. This means you won’t be reducing the total mortgage cost during this time.

- Balloon Payments: At the end of the interest only period, the loan typically transitions to a fully amortizing schedule, requiring you to start making payments that include both interest and principal. This can lead to larger monthly payments or a substantial “balloon payment” of the remaining principal.

Tip #4: Make a Lump Sum Payment

If you find yourself with extra funds, making a lump sum payment towards your mortgage principal can have a significant impact on your overall payments. By reducing the principal amount owed, you can lower your monthly payments and potentially save on interest over the long term. Consider these points:

Pros

- Reduced Interest Costs: A lump sum payment directly reduces the principal balance of your mortgage. As a result, you’ll pay less interest over the life of the loan since interest is calculated based on the remaining balance.

- Faster Equity Building: By lowering the principal balance, a lump sum payment accelerates the process of building equity in your home. This can provide you with a stronger financial position and potentially open up opportunities for refinancing or accessing home equity for other purposes.

- Opportunity Cost: The funds used for the lump sum payment could potentially be used for other investments that might yield higher returns. It’s important to evaluate whether making the payment to your mortgage is the most efficient use of your money.

- Liquidity Impact: If you use a large portion of your savings or investments for the lump sum payment, it might reduce your liquidity, making it harder to access funds for emergencies or other financial needs.

Tip #5: Refinance Your Mortgage

Looking for a more immediate solution to lower your mortgage payments? Mortgage refinancing might be the key. By refinancing your mortgage, you can replace your current loan with a new one, often at a better interest rate or improved terms. Here’s what you need to know:

Pros

- Lower Interest Rate: Refinancing can allow you to secure a lower interest rate than your current mortgage, which can result in significant savings over the life of the loan.

- Reduced Monthly Payments: A lower interest rate or a longer loan term through refinancing can lead to lower monthly payments, providing immediate relief to your budget.

- Closing Costs: Refinancing typically involves closing costs, which can include application fees, appraisal fees, title insurance, and more. These costs can offset some of the potential savings from a lower interest rate.

- Extended Loan Term: If you refinance to a longer loan term, while it might lower your monthly payments, it could increase the total interest you pay over the life of the loan.

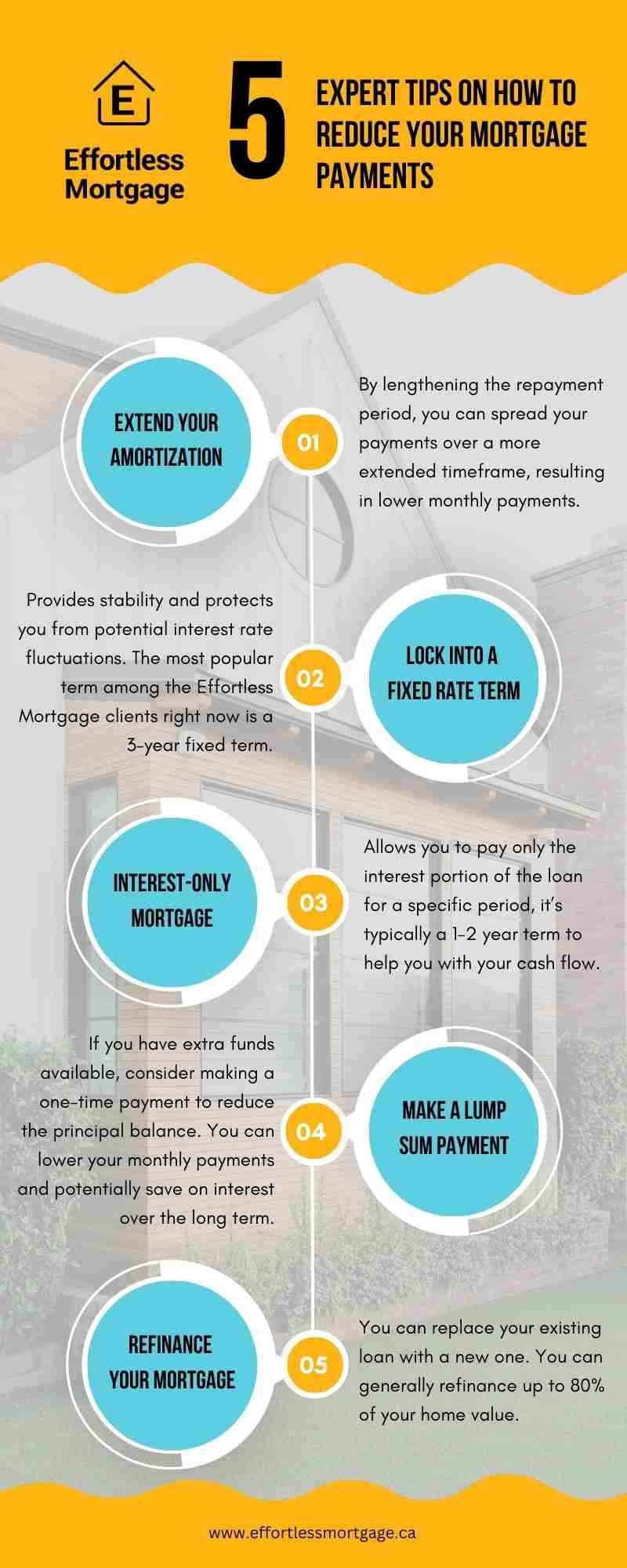

TIPS TO REDUCE YOUR MORTGAGE PAYMENTS INFOGRAPHIC

IN THE NEWS

SIMPLE TIPS TO HELP YOU PAY YOUR MORTGAGE

The inflation in Canada have conducted to an increase of rates and it´s getting more difficult for home owners to pay their monthly mortgage payments. CTV News shared some practical, simple tips to help you pay your mortgage so you don’t find yourself falling behind.

SECURE YOUR FINANCIAL FUTURE WITH EFFORTLESS MORTGAGE

As you look for ways to reduce your mortgage payments, remember that you don’t have to navigate this path alone. The experts at Effortless Mortgage are here to guide you every step of the way.

We are proud to be a part of the top 1% mortgage agents in Canada! We have years of experience and a deep understanding of the Canadian mortgage landscape, our team can help you explore the strategies mentioned above and tailor them to your unique circumstances.

Reducing your mortgage payment isn’t just about saving money, it’s about regaining control of your financial future. Don’t hesitate to reach out to Effortless Mortgage today. Our dedicated professionals are ready to provide you with personalized mortgage solutions and expert guidance. Your path to a more affordable mortgage starts here.

Book a 15-min call to discuss your needs. No obligation.