April Sales Dropped but Prices Stayed Up

House data usually comes out a few weeks after month-end, we now have the information to evaluate April housing numbers. April is an important month to watch because it was the 1st full month after the Covid-19 physical distancing restrictions had been put in place. As such the month of April provides us with important clues whether Canadian Home Prices “Pandemic Proof”? As expected, sales activity dropped by over half month-over-month and year-over-year, but home prices are still holding up. Let’s take a closer look at the key components of the housing data and understand what this means to home purchase and refinance.

Sales Activity Levels Are Down by More Than 50% YoY and MoM

Based on the latest release from CREA, April home resales activities decreased by 57% nationwide from March. It also represents a 58% drop from the same month last year. Many economists believe April to be the low point of housing activitie, i.e. this is likely as bad as it will get. We expect to see gradual increase of home sales over the next few months as different levels of governments start to ease Covid-19 restrictions.

Supply-Demand Remains Balanced

While sales dipped by 50%, we have seen almost the exact same drop on the supply side. New listing numbers fell by 56% MoM as buyers and sellers choose to wait on the side lines. Therefore, the supply-demand relationship is little changed due to Covid-19. This leads to our next topic on home prices.

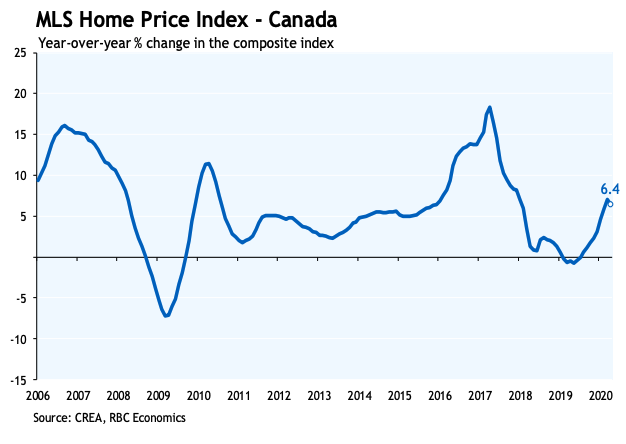

Home Values Are Generally Holding Up

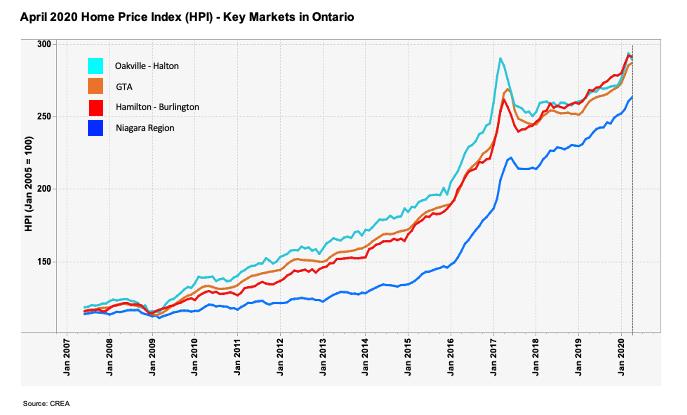

Because the supply-demand condition remains balanced, home values were largely unaffected in April. The overall Home Price Index (HPI) for Canada is still up 6.4% year-over-year. In Toronto, home prices are still up 10.2% year-over-year. Prices in the rest of Ontario are also staying strong through the month of April. Because HPI is a lagging indicator, we expect to see more downward pressure on pricing when governments start to pull back on aid packages and labour market recovers.

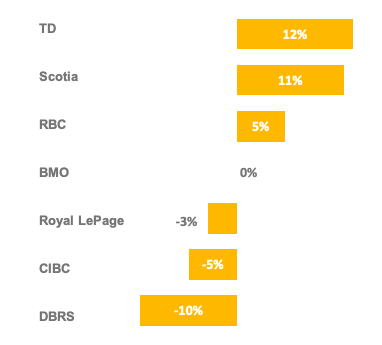

What do Big Institutions Say About prices in 2021? Are Canadian Home Prices “Pandemic Proof”? And who is right?

All big 5 banks plus a few other major financial institutions have come out with their 2021 home price outlook. The forecast ranges from +12% to negative 10%. That’s a pretty wide range. So which prediction is right?

None of them. Because no one can predict the future. To support my argument, I want to quote two people who share the same view as me about forecast. One is a well-known investor, the other is the economist who developed the efficient-market theory:

“Forecasts usually tell us more of the forecaster than of the future.” – Warren Buffett

“Forecasts create the mirage that the future is knowable.” – Peter Bernstein

So, are these forecasts of any use at all?

Behind each forecast, there’s a team of well-paid over-caffeinated and highly educated analysts working day and night to put forward their best guess. So yes, the numbers do provide us a range to work with. To make this set of information complete, many big banks also use -20% HPI in their Covid-19 Stress Test models. It means -20% is, in their view, the worst-case scenario.

However, forecasts usually present the “average number”. Averages are usually misleading. So it’s extremely important to pay attention to the demand-supply conditions of individual market and different dwelling types.

A Tale of Two Dwelling Types –High-rise Condos vs. Detached/Semi/Town Homes

We expect the pandemic to hit high-rise condo markets a lot harder than other dwelling types due to the shifting demand-supply conditions in the market:

- Generally speaking, approximately 50% of all condo units are rentals.

- Many renters are lower income workers in service or hospitality industries who are highly impacted by the cash crunch brought on by Covid-19. As a result, these renters are either moving back home or seeking roommates to share their units. This will reduce the demand for rental units in big cities.

- In addition, there is a flood of AirBnb Units switching from short-term rental to long term rental, increasing supply in the condo rental market.

- Government Aid Package acted as a shot of Adrenaline in providing cash relief for many renters. However, like any adrenaline rush, it wears out quickly. When the economy reopens, some renters will find themselves without a job or the temporary aid.

- With the combination of decreased demand and increased supply, some condo investors, especially the ones with multiple units, may have no choice but put these condos up for sale. Therefore, we do not think the $1000 per sq ft valuation in places like metro Toronto is unsustainable.

On the other hand, we continue to see the resiliency in single-family homes, whether it’s detached, semi-detached, or town homes. The demand for affordable single-family home remains high across all markets, except Oil Regions. In my view, affordability includes homes less than $1 million dollars in satellite cities and suburbs; it goes upward to $1.2-1.5 millions dollars in hot neighbourhoods, such as the Annex, Leslieville, or Mid-town Toronto, and certain neighbourhoods in Vancouver and Montreal. During March and April, many of these “affordable” units were still selling within a week with multiple offers. Therefore, we believe the price of single-family dwelling types, especially in the lower price range, will be trending flat in the next six months.

Are Canadian Home Prices “Pandemic Proof”? Here’s the Bottom Line

- April resales activities are down by 50% YoY and MoM across Canada;

- Both supply and demand decreased by similar magnitude, leaving home prices little changed in the month of April

- We do see downward pressure on price going forward

- However, the future of the home value varies greatly depending on the location and the dwelling type

- If you are in the market for a home, there may be “easy-pickings” in certain markets, where you will encounter less bidding wars

- Whether it’s a good time to sell depends on your property type. If it’s a condo, you may have to sell it at a discount. If it’s a single family home, you may still get a desirable price. Remember, although there are less buyers, there are Way less sellers in the market as well.

- If you are a homeowner and looking to refinance to renovate your home, right now it’s a good time to do that. We also recommend you to check out our refinance guide for more information.

For any mortgage advice on home purchase or refinance, please feel free to book a quick chat with one of our experienced Mortgage Brokers. Or call us at (647) 689-5786. You can also access your customized rate offer by answering a few quick questions.