Effortless Mortgage Referral Program

Benefits of Referring a Customer to Effortless Mortgage We get deals approved! We are the one-stop shop for A, B and Private Mortgages Unlike a

Benefits of Referring a Customer to Effortless Mortgage We get deals approved! We are the one-stop shop for A, B and Private Mortgages Unlike a

“If you are considering buying your first or next rental investment property – then, Congratulations!” Buying income properties has long been one of the most

Bank of Canada rate is expected to increase by 500% in 2022. What does that mean to your mortgage? The market is expecting Bank of

Self Employed Mortgage Can Be Complicated (but this mortgage guide will help simplify and guide you to mortgage success) If you are a business owner,

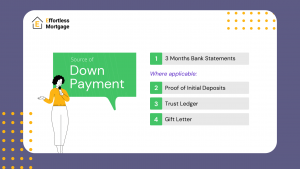

What You Need to Know to Prove the Source of Your Down Payment (for Home Buyers) First off, it is important to know that, due to

“If you follow these steps, the home buying process will be less stressful and you can avoid costly and unnecessary mistakes.” Like many Canadians, owning

“It’s never a done deal, until it’s a done deal.” Closing a mortgage is a big financial transaction, and it can be stressful — especially

Benefits of Referring a Customer to Effortless Mortgage We get deals approved! We are the one-stop shop for A, B and Private Mortgages Unlike a

The Mortgage Qualifying Rate will LIKELY go up as of June 1st, 2021.�How will this impact you? Mortgage qualifying rate will likely go up by

Different Life Situations Require Different Mortgage Options & Recommendations Our 7 days a week live chat service on our website has provided a wealth of